Alberta Power Market Snapshot: Q2 2025

Expanding on last week's overview of Alberta's power market in June, let's now examine Q2 2025 for a higher-level look at its defining trends.

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

The Data

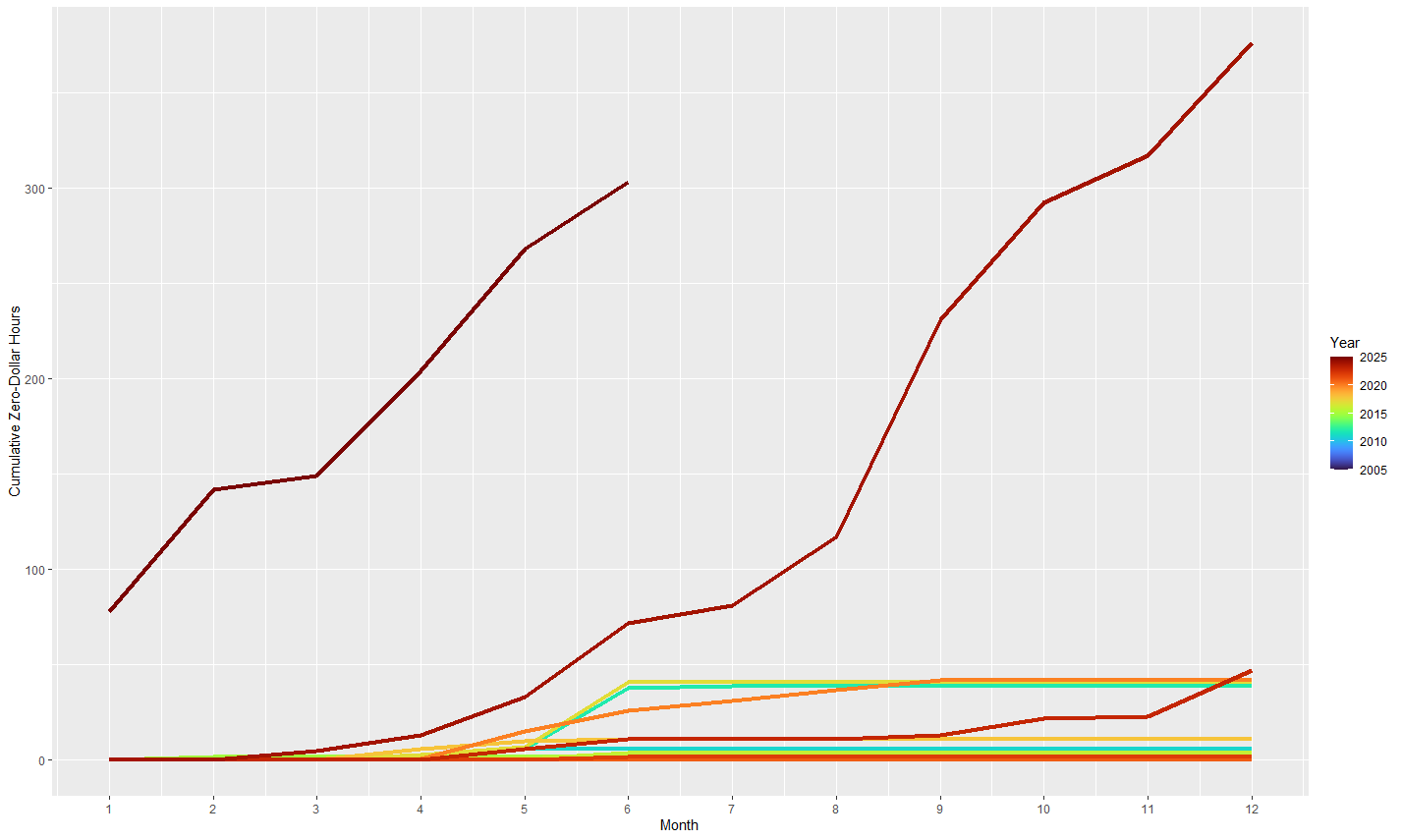

The most striking trend we've observed lies in the cumulative zero-dollar hours over the last two decades. The below chart speaks volumes:

Cumulative Zero-Dollar Hours

Cumulative Zero-dollar hours in the Alberta Power Pool, by Year, January 2005 to June 2025

By the end of June, cumulative zero-dollar hours this year reached 303. This means wholesale power prices cleared at zero for 303 out of 4,344 hours, representing 7% of the time. During these periods, not only did generators receive no revenue, but we also observed record amounts of curtailed generation. While we await Q2 curtailment statistics from the Market Surveillance Administrator, it is worth remembering that Q1 already recorded 160,000 MWh of curtailed generation, predominantly from wind and solar assets.

Q2 significantly amplified this steep upward trend. The 154 quarterly zero-dollar hours were more than double the 67 hours seen in Q2 of last year, which itself was an all-time record for Alberta's quarterly zero-dollar hours.

Q2 zero-dollar hours by year, 2005-2025

The root cause? Alberta’s power market has seen a steep rise in inflexible power generation (gas-fired Cogen, wind and solar), the market has limited interconnections to neighboring markets, and limited storage. Our earlier article “The Change is Structural, Not Cyclical” explores these structural drivers in more detail.

Q2 average prices settled at CAD 40.48/MWh, marking the 5th-lowest level for a second quarter since at least 2005. This represents a return to normalcy after the 2021-23 price spikes, albeit on the lower end:

Q2 average electricity pool prices by year, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted

In Q2, the average cost for the daily lowest-priced 8 hours was CAD 12.24/MWh, marking the second-lowest level in the last two decades. We highlight this metric as it serves as a strong proxy for opportunities available to flexible loads with low capacity factors, such as thermal storage units and certain electric boiler configurations.

Daily lowest-cost 8 hours, Q2 average by year, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted.

The Takeaways

This analysis highlights a clear trend: the accelerating rise of temporary excess supply, curtailments, and zero-dollar hours. While this creates significant opportunities for storage and flexible loads, it simultaneously presents growing challenges for inflexible assets, including gas-fired plants (such as Cogen and some gas-fired steam) and renewable assets. This situation is likely to persist, as substantial new loads like data centers or desperately needed interconnection expansions are still at least a couple of years from coming online.

In the meantime - buckle up for the ride!

And if you have questions or want to test some ideas, please don’t hesitate to contact us, we’d love to hear from you.

Alberta Power Fundamentals Training

As we have explored in our Alberta Power series, electricity presents some of the most significant cost and value opportunities in Alberta's energy sector. To help you leverage these, we invite you to our one-day training course, 'Foundations of Alberta's Electricity Market,' on October 2nd.

This course, designed for industry professionals and business leaders, will provide a comprehensive understanding of the market's structure, key dynamics, and regulatory landscape.

Advance Pricing until September 15th or tickets run out.