Alberta Power Snapshot - September 2025

A month that had it all - Heat Waves, Intertie Maintenance, and an Emergency Grid Alert. And unsurprisingly, prices were very volatile. The new normal?

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

The Data

As usual, we’ll start with the big picture in the form of a price heatmap:

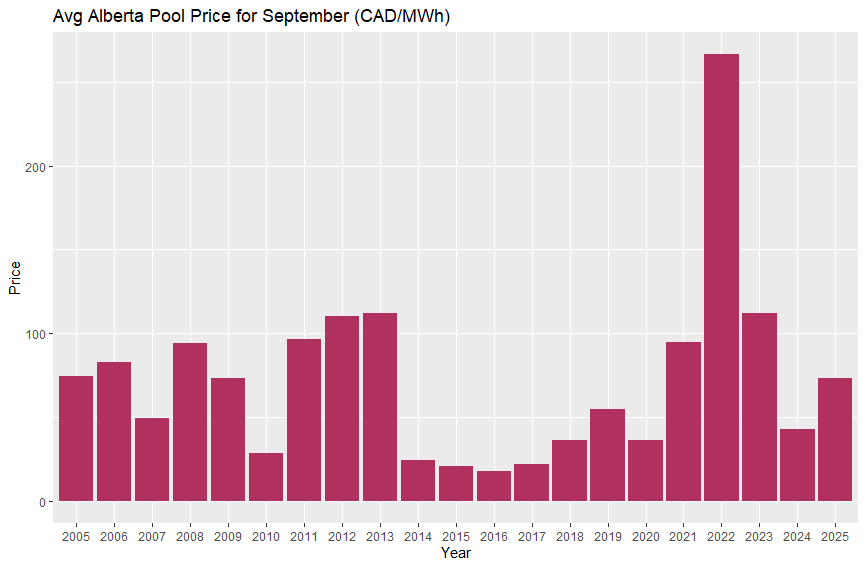

Heat Map of September 2025 hourly Alberta power pool prices

Vertical axis: hour of the day, from hour 0 on top to hour 24 at the bottom.

Horizontal axis: day of the month, from 1st to 30th.

Colors: Pool price, with each block representing one hour

black - “zero-dollar” (CAD 0/MWh);

grey - “ultra cheap” (CAD 0.01-30/MWh),

light green - “cheap” (CAD 30-50/MWh),

dark blue - “normal” (CAD 50-70/MWh),

yellow - “expensive” (CAD 70-100/MWh),

orange - “very expensive” (CAD 100-300/MWh)

red - “extremely expensive” (CAD 300-500/MWh)

maroon - “peak prices” (CAD 500-1,000/MWh)

And this time we indeed have all colors represented, and some very distinctive patterns:

Heat - Finally (!) real summer weather, which increased evening peak demand. And consequently, we can see quite a lot of maroon, red and orange colors from late afternoon through most of the month.

Emergency Grid Alert - on Monday, September 8th at 6.54pm, the AESO issued a grid alert. Demand was around 11 GW with prices already above CAD 700/MWh from 2pm, a gas fired generator had an outage, then the sun was setting and the BC intertie was unable to support the Alberta grid as it was undergoing maintenance - and it got really tight. A close call (looking forward to the more detailed event description in the Q3 MSA Report).

Intertie maintenance - major maintenance on the AB-BC intertie took place in the second half of the month, taking it out of service. The Montana intertie (MATL) was also taken out of service during this period. It was windy most of these days, and we ended up with significant Excess Supply. This resulted in the large zero-dollar blocks in black.

How did this volatility translate into aggregate metrics?

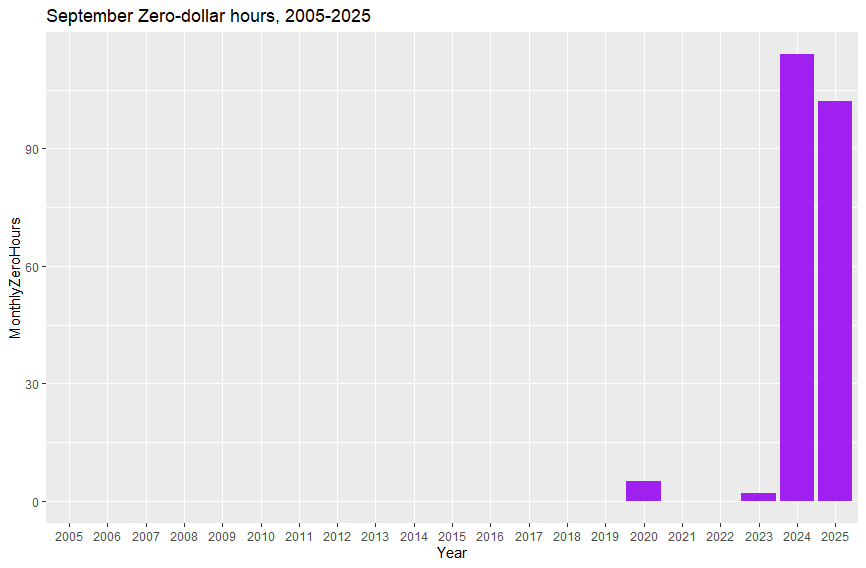

The average monthly pool price came in at CAD 73.05/MWh. The arithmetic average pool price for September since 2005, not adjusted for inflation, is CAD 67.79/MWh - thus September 2025 was rather average in that respect:

September average Alberta electricity pool prices, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted

Let’s move on to the average cost of the lowest-cost daily 8 hours, a metric relevant to flexible loads with low capacity factor. This metric came in at CAD 8.80/MWh, less than one Canadian cent per kWh and the second-lowest value of the last 2 decades:

Daily lowest-cost 8 hours, average for September, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted.

Only 2024 was slightly lower, at CAD 6.36/MWh. And the same picture emerges for monthly zero-dollar hours. Out of the month’s 720 hours, 102 were priced at floor of zero dollars per MWh, slightly below last year’s 114, but significantly above any other year since 2005:

Monthly zero-dollar hours for September, 2005-2025

Thus is the market stabilizing given the slight downtrend since 2024? Not quite - on the 21st of September, the cumulative number of zero-dollar hours for the year exceeded those for all of the previous year (which already set a massive record over previous decades). But we will talk more about that in our quarterly review, coming next week.

As for the main takeaway from September - better get used to a “new normal”. And two other big structural changes are coming - the regulatory restructuring through REM / OTP / Tariff Redesign (and more), and of course data centers. Buckle up!

Training & Webcast

Our Alberta Power Fundamentals course is sold out for tomorrow - Thank you to all participants.

Missed Out? We'll be back in Q1 2026. Contact us to join the waitlist.

In the meantime, we hope to see you during our webinar with Alberta Counsel on October 9th, exploring opportunities in Alberta’s shifting power market.