LNG - Overhyped, Undervalued - or Misunderstood? Part 3 - Market Dynamics

In the first two parts of our series, we analyzed the LNG market's size and the business case for LNG-based power generation. While a deeper dive is possible, our goal is to provide practical, actionable insights for industry practitioners. In this final article, we will connect our previous findings with a review of recent market dynamics. Our goal is to show what these trends mean for structuring and implementing successful deals in the LNG market.

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

A lookback

The current massive LNG boom, projected to expand global liquefaction capacity by around 50% in under five years, is a direct result of high spot prices and market spikes. These spikes were triggered by the COVID-19 recovery and further exacerbated by the interruption of pipeline gas supplies to Europe following the Ukraine war.

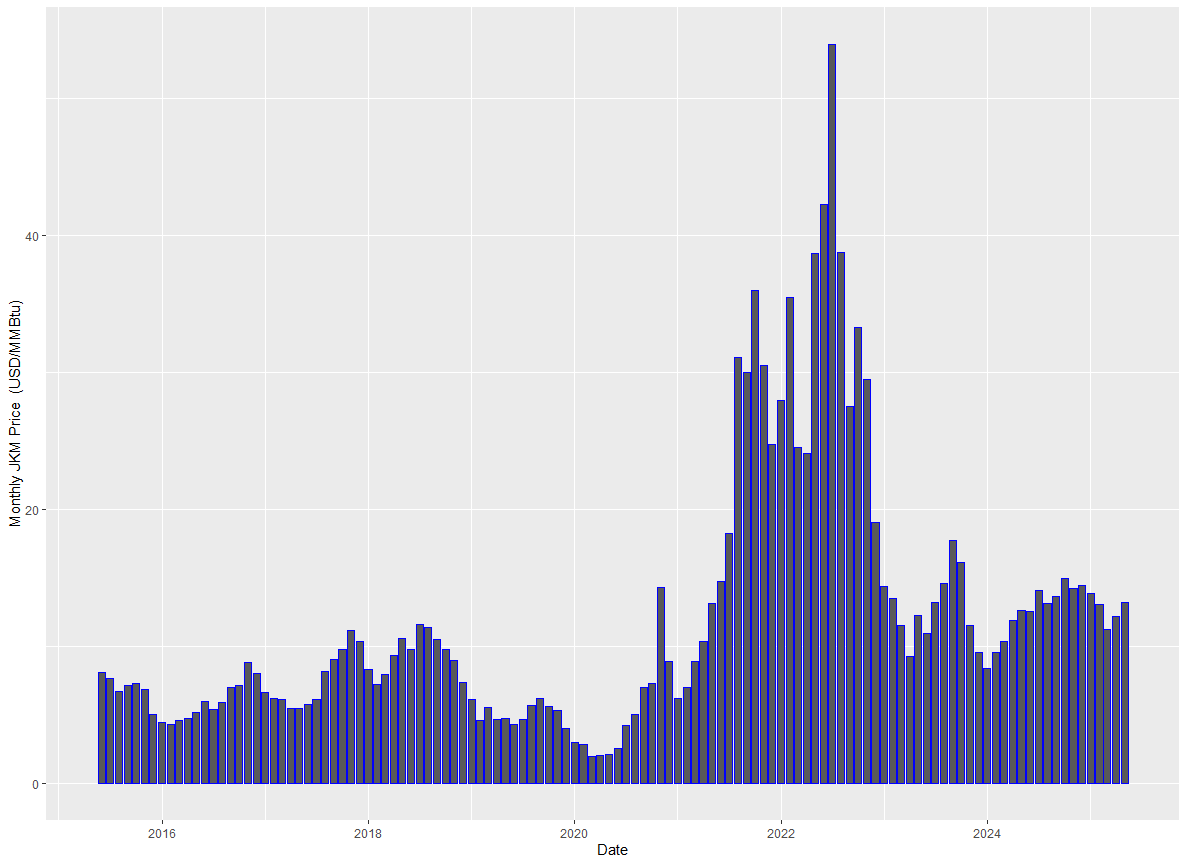

This investment surge stands in stark contrast to a decade ago, when buyers were hesitant to sign long-term agreements. As Shell’s 2017 LNG Outlook* noted, there was a "trend to shorter and smaller contracts" with creditworthy customers preferring flexibility. While this strategy seemed prudent when COVID-19 depressed demand in early 2020—driving JKM prices below USD 3/MMBtu for six months—it ultimately proved risky. The price volatility since then has been unprecedented: from June 2015 to May 2025, monthly JKM prices ranged from USD 2.01 to USD 53.95/MMBtu, with an average of USD 12/MMBtu.

* As a side note, the 2030 LNG demand range forecast of the 2017 report is over 100 mtpa lower than the one shown in Shell’s 2025 report - but the 2025 version no longer shows a gap between demand and expected supply, which shows just how massive the ongoing capacity expansion is.

Monthly JKM prices, June 2015 to May 2025, in USD/MMBtu

A look at the JKM Forward Curve on the CME reveals backwardation, with annual strip prices currently projected to decrease from approximately USD 12/MMBtu in 2026 to about USD 9/MMBtu by 2030. This forward-looking pressure on prices aligns with a key factor we explored in Part 2 of our series: the need for LNG to remain competitive with coal and renewables in power generation.

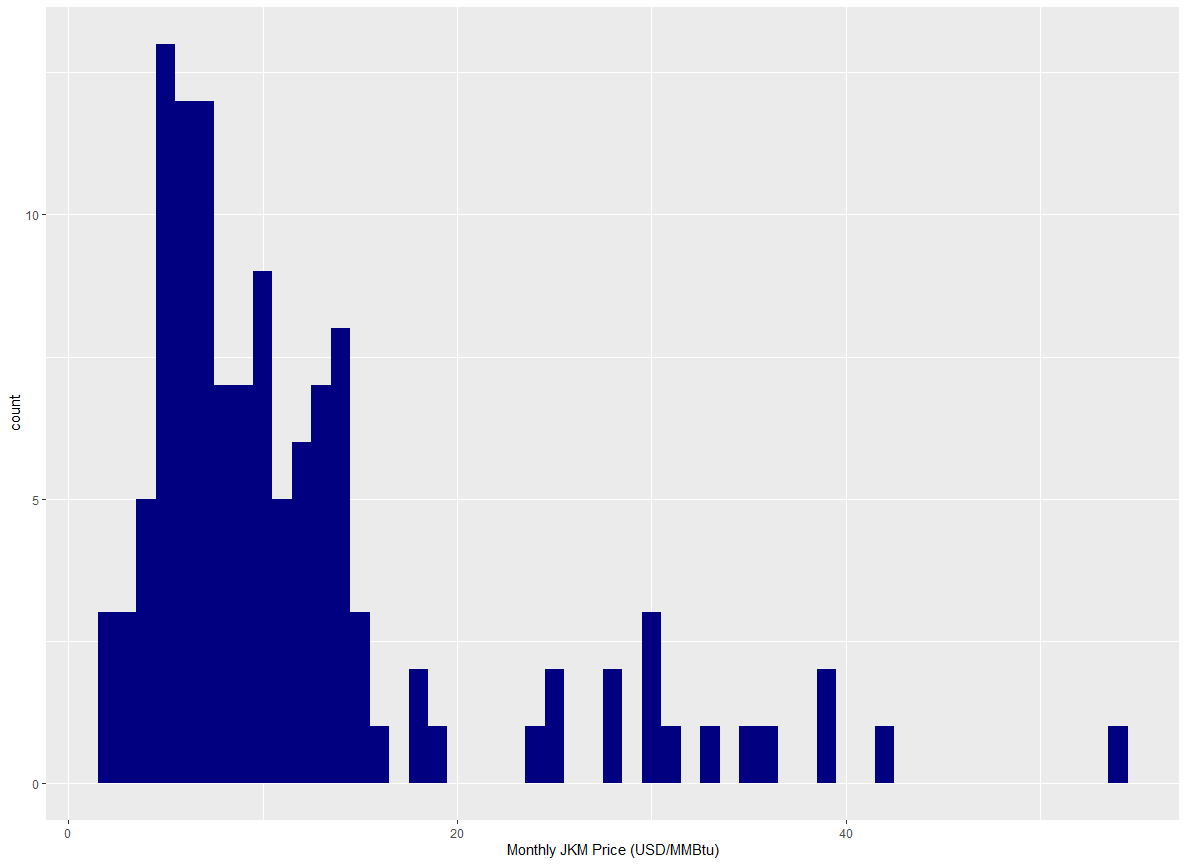

Despite this bearish outlook, many players who are long spot cargoes remain attracted by the potential for large price spikes, which can more than compensate for extended periods of low prices. The last decade perfectly exemplifies this point, as shown by the histogram of monthly JKM prices below:

Histogram of Monthly JKM prices, June 2015 to May 2025

Note the “fat tail” of price spikes on the right, and as a result, the fact that most monthly prices were significantly below the average price of USD 12/MMBtu. What could cause similar spikes in the future? Any threat to the Strait of Hormuz like this June, for example. Or black swan events like Fukushima, Covid-19 and Ukraine in the past.

This is a critical test for market participants, who must have both the financial strength and the support of their board and shareholders to weather sustained periods of low prices if they want to capture those spikes.

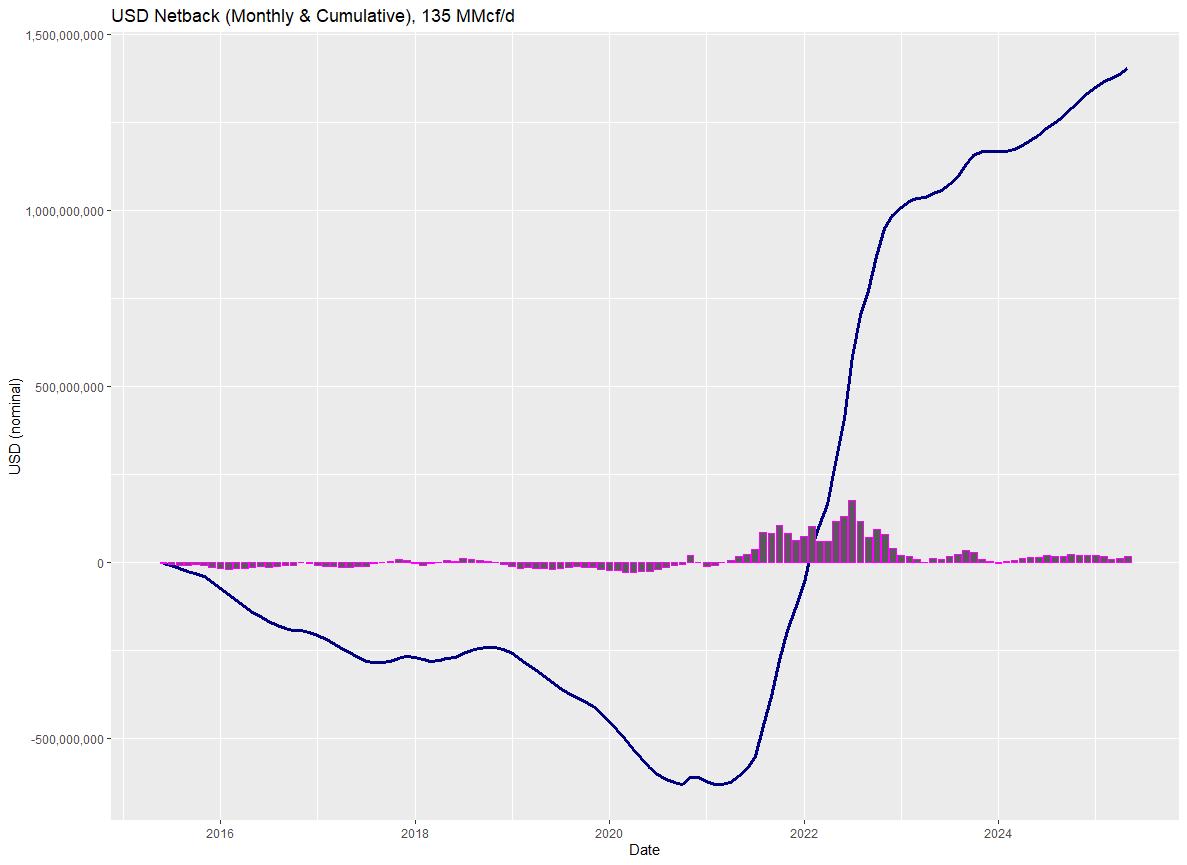

Consider a hypothetical LNG producer selling 1 million tonnes per annum (135 MMcf/d) into JKM at a delivered cost of $9/MMBtu. Over the last decade, their cumulative profit would have been $1.4 billion. This was achieved because a $2 billion profit over the last four years more than offset a $600 million loss incurred during the first six years:

Hypothetical monthly and cumulative netbacks for 135 MMcf/d sold against monthly JKM index prices with USD 9/MMBtu delivered cost

This hypothetical example illustrates how even with a very profitable outcome, key stakeholders need the “nerve” to stay committed to their strategy when the market moves against them. There is no guarantee of a smooth ride—LNG spot prices will remain volatile, with no certainty of prolonged stability or future spikes.

With such a high degree of uncertainty, market participants must accept that prudent cost and risk management are crucial to their long-term viability. And this strategic discipline is far harder to execute than it is to plan.

Alberta Power Fundamentals Training

Being a low cost producer is key to competitiveness in commodity markets - and you cannot be a low-cost producer without optimizing power, one of the top Opex items.

How? We invite you to our one-day training course, "Foundations of Alberta's Electricity Market," on October 2nd.

Designed for industry professionals and business leaders, this course will equip you with a comprehensive understanding of the market's structure, key dynamics, and regulatory landscape. You'll gain the critical knowledge needed to make more informed business decisions and capitalize on new opportunities.

Secure your spot now!