Alberta Power Snapshot - August 2025

Summer finally arrived in Alberta, and power prices surged along with temperatures on several occasions - volatility is back! August also showed an interesting new pattern in the lower price ranges - a new pattern or a temporary phenomenon? Let’s explore.

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

The Data

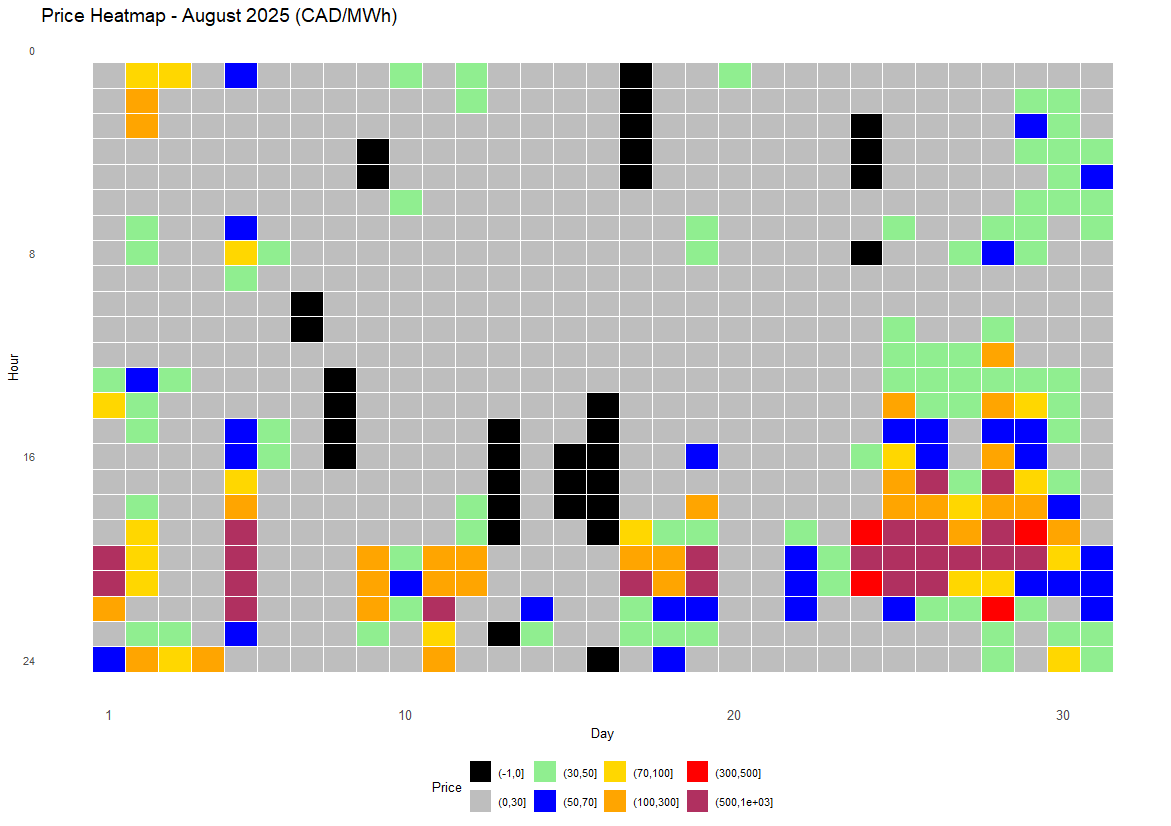

As usual, we will start with an overview of hourly prices in the form of a heatmap:

Heat Map of August 2025 hourly Alberta power pool prices.

Vertical axis: hour of the day, from hour 0 on top to hour 24 at the bottom.

Horizontal axis: day of the month, from 1st to 31st.

Colors: Hourly pool price, with each block representing one hour

black - “zero-dollar” (CAD 0/MWh);

grey - “ultra cheap” (CAD 0.01-30/MWh),

light green - “cheap” (CAD 30-50/MWh),

dark blue - “normal” (CAD 50-70/MWh),

yellow - “expensive” (CAD 70-100/MWh),

orange - “very expensive” (CAD 100-300/MWh)

red - “extremely expensive” (CAD 300-500/MWh)

maroon - “peak prices” (CAD 500-1,000/MWh)

While ultra-low prices were prevalent, the data also highlights instances of extreme price volatility. We see very high hourly prices (red and maroon) during late evening hours on hot days, when solar generation wanes but demand remains high. In contrast, zero-dollar hours (black) are increasingly shifting from classic overnight off-peak periods to the afternoon, when solar and wind generation are at their peak.

This shift signals a significant structural change. The Alberta Market Surveillance Administrator (MSA) noted in its Q2 2025 report that in April, on-peak prices were, for the first time, lower than off-peak prices. This further reinforces the need for market participants to update their strategies.

Despite these dynamic hourly swings, the average monthly pool price was CAD 50.35/MWh, marking a 47% increase from August 2024, yet remaining on the lower end for a typically volatile month.

August average Alberta electricity pool prices, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted

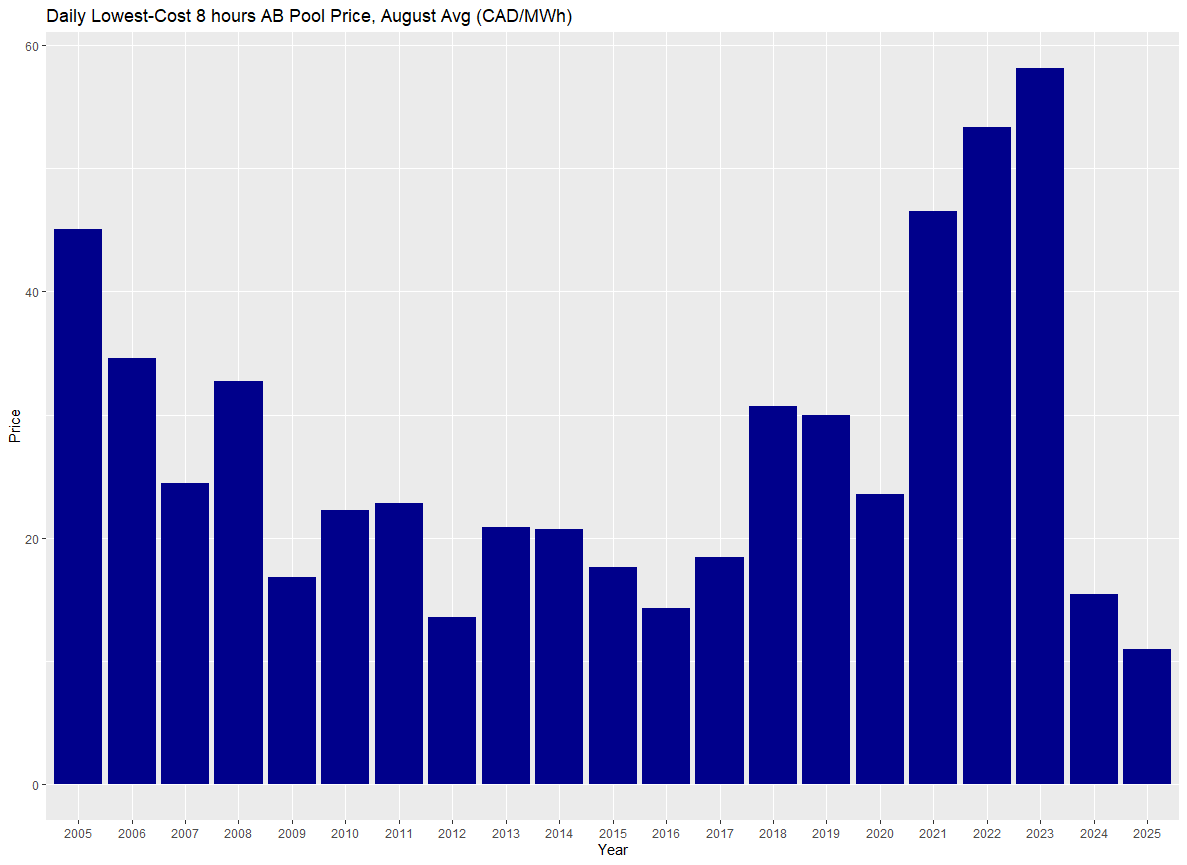

Daily lowest-cost 8 hours, average for August, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted.

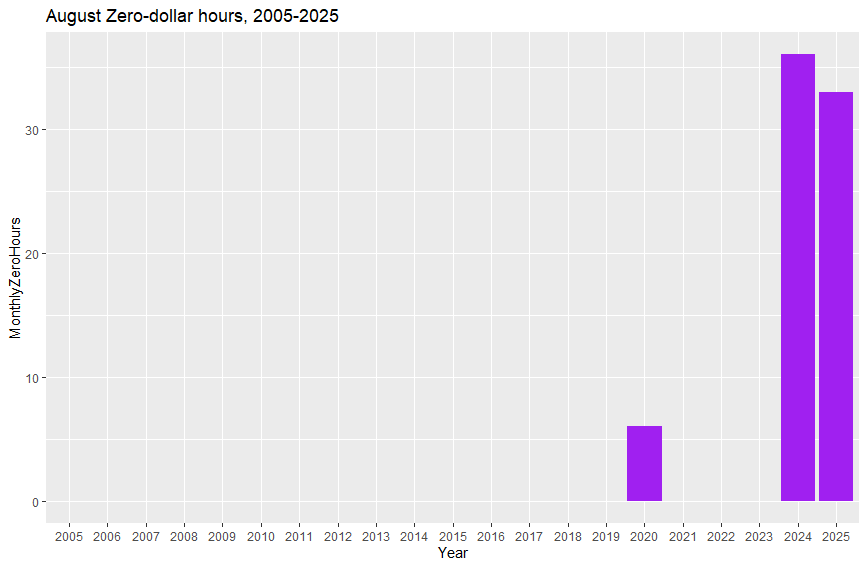

This means that customers with the flexibility to use power when prices are low reaped significant savings, benefiting from wholesale rates that dipped to just 1 cent per kWh. While low prices were common, this record was not set by zero-dollar hours. In fact, there were 33 zero-dollar hours in August—the second-highest number for that month since 2005, just shy of last year's record of 36:

Monthly zero-dollar hours for July, 2005-2025

The recent record for lowest-cost daily pricing was primarily a result of a surge in near-zero-dollar hours, not just zero-dollar hours. There were 12 hours with pool prices between CAD 0.01 and 1/MWh, a sharp increase from previous years. For comparison, this same price range was observed for only 3 hours in 2024, 1 hour in 2012, and zero hours in every other August since at least 2005.

It is too early to determine if this pattern is a temporary anomaly or a new market feature, particularly given the historical volatility of August pricing. A new negative price floor of -CAD 100/MWh, effective in 2032 as just confirmed by the Alberta Electric System Operator (AESO), will eventually change this dynamic. Until then, the rise of near-zero pricing serves as a crucial metric for evaluating periods of excess supply on the grid.

Takeaways

Recent trends in the market confirm a period of significant structural change. Looking ahead, three major reforms will add a new layer of complexity to the Alberta power market starting in 2026:

Restructured Energy Market (REM)

Optimal Transmission Planning (OTP)

Tariff Redesign

Together, these reforms will fundamentally reshape the market for both power generators and electricity customers. Staying ahead of these changes is now critical. It's time to move beyond static, "set and forget" strategies and build a more dynamic approach.

Alberta's Power Market is Changing.

Are You Ready?

The 2026 Market Restructuring is coming. Get ahead of the curve by joining peers from Canada’s leading energy companies for our one-day training course on October 2nd.

Gain the foundational knowledge you need to navigate what's next.

Limited Seats. Register by Sept. 15th for Advance Pricing.